The Fall of Fiat, the Rise of Tokens: Navigating the Collapse of Traditional Finance and the Ascent of Digital Wealth

Hello to all the future investors at Diamond Ridge Financial Academy!

I'm Charles Hanover. It's a real pleasure to explore the wisdom and opportunities of investing with you during this time of big changes. The global economy is going through major turbulence; frequent policy shifts and wild price swings are pushing us to look at the bigger picture and sharpen our instincts to spot structural opportunities. Being able to judge market trends accurately and having a deep understanding of what’s going on have become key to growing wealth.

Tonight, we’ll start with the latest market updates. We’ll take a close look at how the traditional financial system is shaking, and how global assets are being deeply restructured. We’ll also focus on the rising trend of asset tokenisation and the real opportunities it brings.

Today, the UK stock market closed slightly higher — the FTSE 100 was up 0.6%. But this bounce was mostly a technical rebound after a sharp drop the day before. The market is still facing a lot of uncertainty. Gold stocks went up thanks to the surge in gold prices, but travel-related stocks like IAG and InterContinental Hotels kept falling. This shows that investors are clearly getting more cautious about the economic outlook.

There’s also buzz about Shein possibly going public in London, which caught some attention. But with tensions rising between China and the U.S., and Trump once again talking tough on tariffs, global investors are staying cautious. On top of that, the UK is dealing with rising debt and slowing growth. So even though the FTSE bounced today, the risks under the surface remain, and it’ll probably keep moving downward in the short term.

As for the U.S. stock market, the three major indexes did bounce during the session and might end the week higher. But overall, the market is still weighed down by policy uncertainty. The U.S. tariff moves have raised fresh worries about global supply chains and a possible recession. The dollar is under pressure, bond yields are climbing, and gold is surging as people look for safer options. The surprise drop in March’s PPI helped ease inflation fears for a bit, but with high tariffs sticking around, inflation is very likely to come back in the second half of the year. Right now, this rebound in U.S. stocks feels more like a short-term technical move — it's not a clear trend reversal. The real risks are still building up under the surface.

Right now, the whole market is still being dominated by uncertainty around tariff policies. The root cause of price swings has gone far beyond fundamentals — it’s all caught up in a mix of policy games, strategic fear, and capital losing its anchor. Especially with Trump pushing this new round of tariff hikes, on the surface, it looks like there’s a 90-day “grace period”, but the market knows this isn’t a time to relax. It’s just the start of another round of policy flip-flops and strategic fighting.

The market is closely watching the Trump administration’s next move in the tariff war. According to the latest update, this Wednesday the U.S. government said it would lower base tariffs to 10% for most trade partners as a “gesture of goodwill”. But at the same time, it slammed Chinese goods with a shocking 145% tariff hike. This is the most aggressive punishment from any Western country to a major trade partner since World War II. China didn’t hold back either. It raised tariffs on U.S. goods from 84% to 125% and made it clear in a statement: “At this point, raising tariffs further makes no economic sense and will just become a joke in global economic history.” In other words, Beijing no longer expects to ease tensions through talks — they now see this conflict as long-term and are getting ready for a drawn-out fight.

Europe also made a move. The EU announced that its top trade representative will head to Washington on Sunday, hoping to strike a deal before hitting back. But realistically, the chance of a stable agreement any time soon is very low. Trump’s style of “maximum pressure + sudden reversal” has made potential negotiators seriously doubt his credibility. Meanwhile, opinions are starting to split on what the Fed should do. Minneapolis Fed President Neel Kashkari said in an interview that yes, the markets are under pressure — but not in full panic mode like during the 2020 COVID crash. He stressed that the Fed won’t step in to control bond yields and won’t overreact to market swings.

But the bond market clearly disagrees. Over the past 48 hours, U.S. bond yields have shot up fast, while the dollar has been falling hard. A number of hedge funds are now warning that the dollar’s role as a reserve currency is facing a major trust crisis. ING strategist Francesco Pesole and others said in a new report that the current flow of capital already shows signs of a “real dollar crisis” starting to form. What’s being dumped isn’t just stocks or bonds — it’s a broad pullback from U.S. assets altogether. As they said, “The crashing dollar has become a signal for the global ‘sell America’ mood.”

Even though U.S. Treasury Secretary Bessent tried to calm markets during a cabinet meeting — saying 75 countries are willing to open trade talks with the U.S., and Trump himself said he’s open to a deal with China — the market isn’t buying it. James Athey, a fixed-income manager at Marburg Investments, said bluntly: “We’re in a mess, and it’s worse than a month ago.” He warned investors not to be fooled by one-day rebounds and to stay clear-eyed through the noise. And he’s right. Since Trump announced a delay on some tariffs, markets did bounce a bit but cooled off fast. Safe-haven assets like bonds and gold jumped right back up — and that says it all. The market is starting to accept a new reality: global risk has entered a structural phase, and no policy statement or headline is going to flip that around overnight.

As U.S. sovereign bond yields jump sharply, global bond markets are reacting. The yield on the UK's 30-year government bond recently shot up to 5.6%, the highest since 1998, reigniting fears of another round of systemic financial risk. In an interview, Charlie Morris, founder of ByteTree, said, "Looks like the UK has been living beyond its means for way too long. Since 2001, it's barely run a balanced budget. The bond market's had enough." He added that in this kind of environment, investors will definitely look for safer assets. "Money looking for diversification won't just go to gold; it'll flow into BTC too."

What this really shows is a growing consensus that trust in the sovereign credit system is wearing thin. With the economy slowing, budget deficits exploding, and little room left for monetary policy moves, the stability of traditional financial systems in the U.S. and UK is starting to shake. This is especially serious for many people nearing retirement, who now have to rethink their reliance on public pension systems. In the UK, lots of folks pinned their retirement hopes on the state pension system, not realizing that this wave of financial stress has already torn that system apart in real life.

The implications of rising bond yields extend beyond the government's increased borrowing costs. They also inflict significant damage on pension funds that rely on fixed-income assets. These assets have suffered a substantial decrease in value, leading to a reduction in fund net worth and exacerbating the asset-liability mismatch. The sudden surge in UK bond yields has evoked memories of the 2022 pension crisis. At that time, a "mini-budget" triggered a spike in yields and a pound crash, pushing numerous pension funds using LDI (Liability-Driven Investment) strategies into a margin crisis. They were compelled to offload substantial amounts of UK bonds, nearly causing a collapse of the entire financial system.

One alarming fact: UK pension funds held nearly 28% of all UK government bonds then. The damage would be catastrophic if such a large portion of the market were to be hit by a liquidity crisis and sold at fire-sale prices. In that "selloff, drop, margin call, more selloff" death spiral, the bond market could disintegrate in a matter of seconds. The Bank of England had to intervene with an emergency plan to purchase long-dated bonds just to halt the spiral. However, this costly intervention exposed the true fragility of the UK pension system and revealed that the entire Western financial system is teetering on the brink of dysfunction. Now, with the UK back in a high-inflation, high-interest-rate cycle, these hidden risks are resurfacing.

The old financial system is clearly breaking down with recession pressure and Trump's tariff moves to ramp up global trade tensions. More than that, we're seeing the start of a full-blown shake-up in the entire social safety net. Pension systems, healthcare coverage, subsidies and all kinds of welfare programs were built on assumptions like "sustainable budgets" and "cheap borrowing." But now, these assumptions are struggling on the brink of collapse.

Especially during this wave of transformation, many older regular people still hope that the government will fulfil its promises regarding pensions. But the reality is that continuous fiscal overspending, currency depreciation and shrinking asset bubbles have gradually pushed the so-called “high welfare” lifestyle further away. From the UK to the US, from Europe to many countries in Asia, the collapse of traditional finance is igniting new social anxieties, with pensions at the core, and this crisis won’t heal just because any country makes reassuring statements.

In other words, we’re not just experiencing a market fluctuation but a systemic restructuring of wealth. From a macro perspective, the profound transformation of the global economy is not only reshaping industry models and the monetary system but fundamentally disrupting the entire operation logic of traditional finance. The social welfare systems that were taken for granted over the past few decades may likely appear in a completely different form in the future. And “asset transformation” is no longer just a matter for governments, institutions or professional investors. It’s a profound change that affects the future lifestyles and survival thresholds of every ordinary person.

This also means that, in the context of the accelerated global asset digitization process, investing in digital assets is no longer just an option for “diversification” but the only way for regular people to preserve the wealth accumulated over the past few decades or even generations. If someone hasn’t yet realized the strategic significance of “asset digitization” at this stage, they will find it very difficult to hold onto their wealth in the next round of systemic financial turbulence.

From a personal wealth planning perspective, current asset strategies can generally be divided into two categories: One is the high-net-worth group with liquid assets exceeding $10 million. If they want to preserve their wealth in the future economic structure, they must actively embrace policy direction and capital trends, completing a strategic transition from traditional assets to digital assets. The other group consists of ordinary investors who have not yet completed capital accumulation. They are at a crucial window for making a breakthrough. By taking advantage of the cyclical dividends brought by the reshaping of the global financial order and seizing the opportunities in emerging policies driven by quality digital assets, “early-stage shares,” they can potentially complete a structural leap from individual breakthroughs to class transitions by buying low and selling high.

This trend is becoming increasingly clear in the flow of global funds and US regulatory movements. Just yesterday, Ripple and Boston Consulting Group jointly released a major report titled “Approaching the Tokenization Tipping Point,” which pointed out that the global financial market is about to undergo a structural infrastructure replacement. The traditional financial system has been running on a decentralized, inefficient and disconnected network for decades, and it is no longer in line with the efficiency, liquidity and transparency required by modern society. The rise of tokenization is gradually breaking these system boundaries, turning “asset units” into “programmable smart protocols,” not only improving efficiency but also reconstructing the value perception logic of the financial ecosystem.

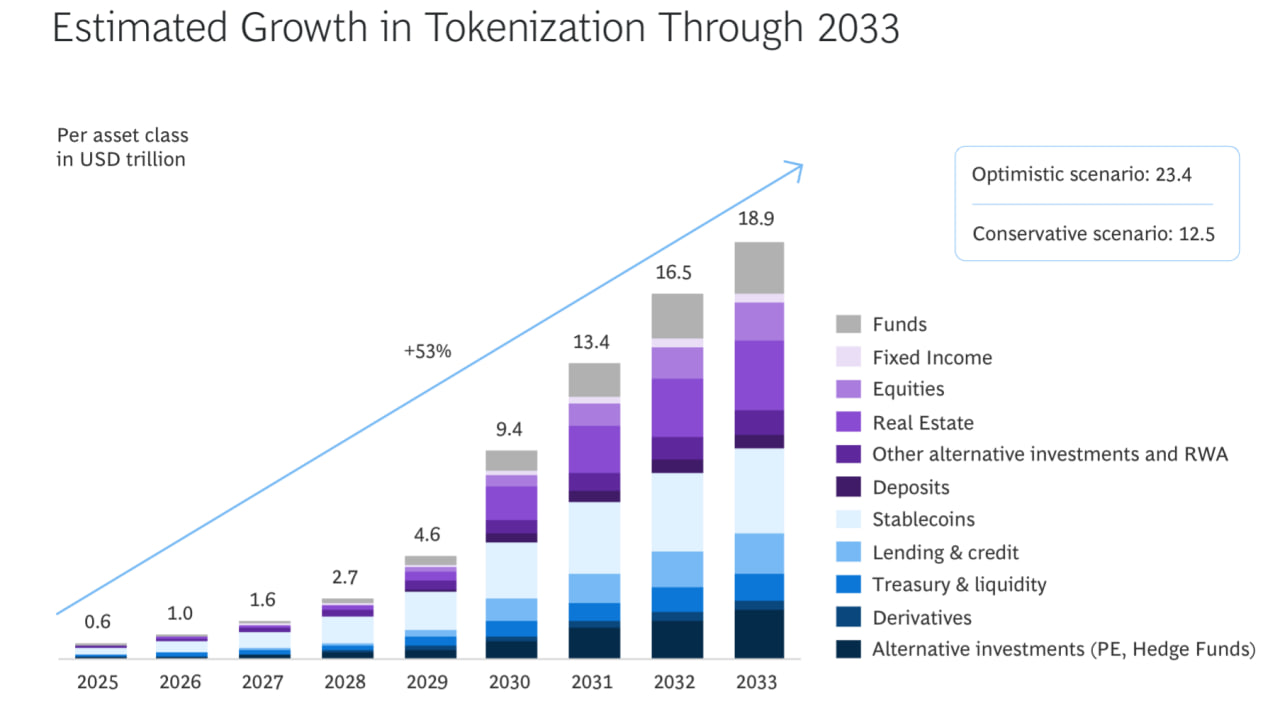

The report forecasts a significant surge in the tokenization of real-world assets by 2033, with the market expanding from $0.6 trillion in 2025 to a staggering $18.9 trillion. This growth, more than five times the size of the UK’s GDP, is underpinned by an annual compound growth rate of 53%. Such a promising trajectory suggests that stakeholders in this space could witness their assets grow by over 50% every year.

Right now, the U.S. is leading the world by pushing tokenized funds, government bonds and mortgage-backed assets. Under President Trump’s leadership, the government is also rolling out policy benefits. A new bill has officially banned the IRS from collecting on-chain transaction data from decentralized crypto platforms. This is seen as a major step toward clear laws for digital assets in the U.S., meaning that tax transparency and legal compliance for on-chain assets will likely be part of the new financial order.

Ripple has clearly positioned XRP as the bridge asset for global tokenized assets. It’s working on real-world use cases like cross-chain payments, financial settlements and capital transfers. What’s important here is that Ripple and BCG pointed out in the report that tokenization isn’t just a “tech upgrade”. It’s a rebuild of the entire global financial infrastructure. It’s turning old, static financial tools into dynamic software logic. Once this change goes mainstream, it will create a new foundation where “software defines assets.” Those who get in early and understand this model will have a major edge in how they see and manage assets.

At the same time, what’s actually happening in the market is proving this shift is real. Right now, even though the global market is in risk-off mode and most stock markets are weak, BTC surged over 3% before U.S. markets opened, making a key technical reversal move. Then, when the S&P, Nasdaq and Dow opened and dropped nearly 1%, crypto stayed strong and even helped push a small bounce in stocks. This isn’t a short-term move to avoid risk; it’s structural capital leaving the old system and flowing into a digital economy that has more future value built into it.

From a money psychology point of view, BTC is no longer seen as just a “speculative asset.” It’s becoming the “value anchor” of the new financial system. Especially now, with national credit systems swinging wildly, trust in the dollar weakening and major fiat currencies stuck in inflation and broken policies, crypto’s “certainty logic” stands out even more. People are starting to realize that the thing that survives long-term cycles isn’t a country’s power to print money. It’s a trust system built on code, public blockchains and transparent consensus.

From a technical point of view, BTC is now moving near the middle line of the BOLL. After a period of sideways consolidation, it has built up enough energy to move upward in the short term. If it can break through the resistance of the middle band in the next few trading days, we may see a clear trend reversal and more room for prices to go up. But this time, the reversal isn’t just about technical signals; it’s also being pushed forward by global policy support. That includes the buildout of AI infrastructure, the fast progress of the digital dollar plan, standardizing on-chain clearing systems, and legal exemptions for new payment methods. All of these will become long-term fundamental support for BTC.

More importantly, the market is no longer looking at digital asset price moves through the lens of speculation. Institutions are starting to reprice these assets from a “value re-evaluation + asset allocation” perspective. Once this mindset shifts and locks in, Digital assets won’t be seen as a fringe tool for speculation; they’ll be a core part of mainstream capital portfolios. At that point, BTC won’t just be a safe haven for personal assets anymore. It’ll be a standard piece of long-term portfolios for sovereign wealth funds, pension institutions and major family offices. The next phase of the financial system won’t be centred on rotating between stocks and bonds but on building a new wealth anchor around “algorithm assets.”

That’s why what we’re seeing right now isn’t just a simple price bounce; it’s the beginning of a reset in the entire financial order. From new regulations to capital flow shifts, from technical patterns to institutional buying, from Ripple’s tokenization roadmap to the data protection bill signed by Trump, every signal is pointing in the same direction: digital assets are moving to the centre of the stage. Anyone who misses this leap will be left far behind in the next wave of wealth reshuffling. But those who understand early, take action and build positions steadily will become the “natives” of the new order in the coming decade.

In this context, subscribing to new tokens that follow the big trend of the times is now one of the hottest and most reliable investment directions in the market. Especially the HGS project, which is now entering the final countdown of its subscription phase, stands out as a strong example of the “pre-IPO logic,” backed by both tech innovation and policy tailwinds. The subscription bar for HGS has already passed 550%, which means its launch price is already locked in with more than 5x upside. And this upside isn’t based on future market bets. The system has already confirmed it as a base return. This kind of structural certainty is super rare in today’s highly volatile financial market.

Of course, the hotter the subscription, the harder it gets to win a share. The demand is way higher than supply, so the chances of getting selected aren’t that big. But if you do get in, the returns can be huge. Based on current market feedback and sentiment, HGS will likely keep its momentum after listing, and the price could push to $8 or even higher. In other words, the 5x we’re seeing now is the locked-in “floor return,” and the secondary market price could stretch toward the $8–10 range in the short term, giving it real potential to grow your capital and expand your assets.

It’s worth noting that HGS is just one example from the healthcare industry under the current wave of tech innovation. In terms of track size and potential ceiling, its premium potential is still relatively mild compared to ultra-high-frequency concepts like AI, robotics and the metaverse. But even so, HGS is still in an early stage and already triggered strong market buzz in a short time. What this reflects is how much the on-chain capital market is paying attention to undervalued high-quality assets. As U.S. policies keep loosening up, Wall Street funds are flowing into blockchain infrastructure projects faster than ever, which will fuel the next round of token project breakouts. That doesn’t just mean more quality assets will come out. It also means the market’s premium structure is going to be revalued. And those who can get in early and stay involved will become the real winners in this wave of wealth growth.

That’s all for tonight’s session. We started by talking about how the global tech revolution is shifting the whole economic structure, then moved on to how tariff policies are triggering a credit crisis in traditional financial assets. We also walked through how policy support is powering the rise of digital assets. In this big picture, investing in new tokens is now the most powerful way to break through, like getting into early-stage pre-IPO stocks. It’s opening up a real chance for a wealth jump. Projects like HGS aren’t just a passing trend; they’re model assets backed by a full narrative. They show us how real opportunity comes from policy support, capital inflows, tech development and market trends lining up at the same time.

Right now, HGS is almost at the end of its subscription phase, and the window for getting in is closing fast. Grabbing this opportunity could be the start of a major shift in your personal wealth curve. Under the strategy of Project Ascension, we’ll keep picking and investing in top-tier new token projects like HGS and build a digital asset portfolio designed to ride through full economic cycles. But more than that, this isn’t just a path to financial freedom. It’s the start of a full identity upgrade. Welcome to the “Millionaire Incubator.” Let’s build the future of the global elite investment club together and embrace the new wealth order of the digital age.