Mastering Market Cycles: The Power of Innovation, Data-Driven Trading, and Seizing Opportunities in a Shifting Economy.

Hello, outstanding students of Diamond Ridge Financial Academy!

I'm Charles Hanover, and it's a great honour to embark on this journey of exploring the secrets of quantitative trading with you. Right now, the global economy is going through rapid changes, from geopolitical tensions to the opportunities brought by tech innovations. In this complex environment, our quantitative trading system has delivered outstanding results.

Opportunities in the market always belong to those who can make precise judgments and take action. The past market has proven that different choices lead to entirely different outcomes. Today, we will start with the latest market trends, explore the flow of wealth and use cutting-edge tools to seize high-quality investment opportunities.

Today, the UK stock market showed a range-bound recovery. The FTSE 100 closed up 0.54%, mainly driven by strong corporate earnings, rising gold prices and increased demand for safe-haven assets. Fresnillo surged 4.8% as gold prices soared. However, geopolitical risks heavily influenced market sentiment, especially with the escalating US-China trade tensions. The US Postal Service suspended package deliveries from China and Hong Kong, adding more uncertainty to the market.

On the UK economic data side, the Jan PMI showed that job cuts hit a four-year high, reflecting growing concerns about the economic outlook. New car sales declined for the fourth straight month, signalling weak consumer spending. Despite these challenges, the overall market performed well, supported by strong corporate earnings, with the FTSE 100 outperforming most European markets.

Meanwhile, the US stock market saw even more volatility. Overall, the US moved lower, led by tech stocks, as investors focused on US-China trade tensions, disappointing tech earnings and economic data. After the US announced a 10% tariff on Chinese goods, China immediately retaliated, imposing an extra 10%–15% tariff on US products and officially filing a complaint with the WTO.

In addition, the Trump administration plans to impose a 25% tariff on Canadian and Mexican goods. Although this has been delayed until Mar, markets are already worried about its long-term impact on construction and manufacturing. The Canadian lumber tariff issue is particularly concerning, with industry studies showing it could increase US homebuilding costs by $29K, further driving up real estate market pressure. With all these uncertainties, investors are seeking safe-haven assets, pushing gold prices past $2.88K, hitting a new all-time high.

The tech sector took the biggest hit in this market correction, and investors are doubtful about the future of big tech companies. Many believe these companies face a tough choice. On one hand, they need to invest more to stay competitive in AI and advanced technology. On the other hand, they have to cut costs to maintain profits. This has shaken investor confidence. Google's parent company, Alphabet, reported earnings that fell short of expectations. The market is worried about its slowing cloud business growth and the long-term profit pressure from AI investments. Apple wasn't spared either. Reports suggest that the Chinese government might investigate Apple's App Store fees and policies. If that happens, it could further escalate the US-China tech war and raise concerns about Apple's future growth.

In the economic data, the US Jan ADP jobs report exceeded expectations, adding 183K jobs, beating the forecast of 150K. This suggests that despite rising trade tensions, the labour market remains strong. However, a strong job market could impact the Fed’s policy direction. Previously, markets expected the Fed to cut rates by 100 basis points in 2025, but if job growth remains strong, the rate-cut timeline could be pushed back, or the cuts could be smaller. Meanwhile, the US Dec trade deficit widened by 25% to $98.4B, bringing the full-year trade deficit to $918.4B. This highlights how Trump’s tariff policies are reshaping global trade, increasing uncertainty in imports and exports and adding more market instability.

In this market environment, an investor’s mindset is more important than ever. Investing is a lot like life. Everyone has different experiences and makes different choices. Some people are born with great resources and opportunities, while others have to work hard, gain experience and build their success step by step. The same goes for investing. Investors have different backgrounds, knowledge, capital and execution abilities, so their results will naturally vary.

Some learners have faced multiple setbacks in the market, leading them to develop a fixed mindset. They start believing that investing is always difficult and uncertain. Losses feel like the norm, while profits seem like a lucky accident. Some even get anxious after making consistent gains because they expect losses to follow. This is actually a common psychological pattern. Past failures create a mental habit that makes people doubt their abilities. But investing isn’t about struggling to survive; it’s about identifying the best opportunities, applying the right strategies and making steady profits amid market fluctuations.

Success always comes from the right timing, a good environment and personal effort combined. Hard work matters, and so do market conditions and opportunities. Take Warren Buffett, for example; his sharp judgment and patience were key, but his success also depended on the long-term growth of the US economy, the rise of high-quality companies and a mature capital market. Without a stable, growing economy, the power of compound returns in value investing wouldn’t be as strong.

The same principle applies everywhere. Whether it’s Elon Musk in electric vehicles and space exploration or James Dyson in tech innovation, their success isn’t just about talent and hard work; it’s also about the timing, the era of rapid tech advancement and market demand.

Investing works the same way. Even the best traders can’t make consistently high returns if the market isn’t offering the right opportunities. And when opportunities do exist, those who lack the ability to spot them or execute them properly will still miss out.

Lately, many of our learners have made great short-term trading profits, not because they got lucky but because the market has entered a unique historical cycle—Trump’s trade policies have caused extreme volatility, which happens to be the perfect environment for short-term traders. Our algorithmic trading system went live during this exact period, and thanks to the increased market fluctuations, we were able to test and refine our strategies in real conditions.

Even today, many traders are making significant gains, not by chance but because the US ADP jobs report was released, providing a clear trading signal. Making money in the market is not a matter of luck. It’s about truly comprehending market logic and executing the right strategy at the right time.

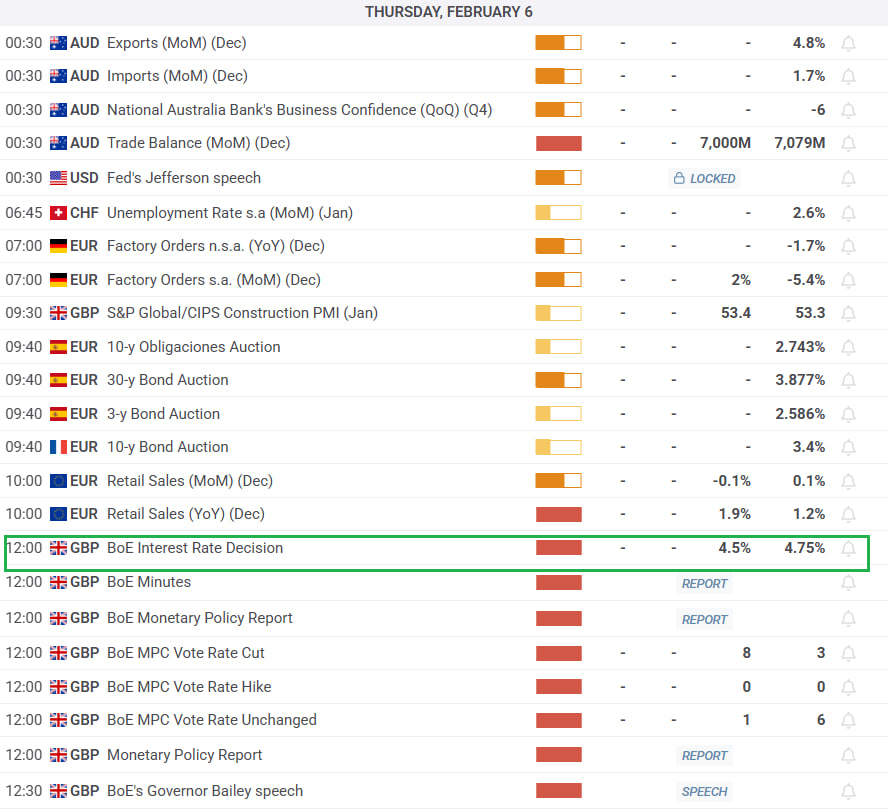

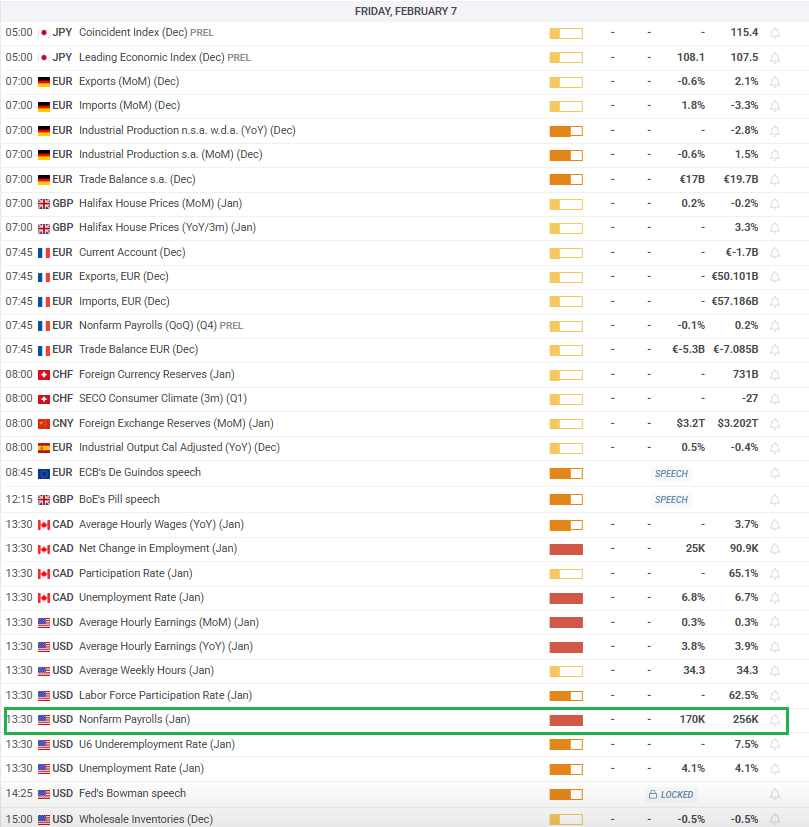

Similar trading opportunities, such as tomorrow’s Bank of England rate decision and Friday’s US non-farm payroll data, will continue to appear this week. Both of these reports have a significant impact on the market. The Bank of England’s rate decision will directly determine the direction of the British pound and affect capital flows across the European market. At the same time, the US non-farm payroll data is a key factor in the Fed’s monetary policy decisions. For short-term traders, the most important thing is to focus on high-volatility moments in the market, and these major economic reports are the key drivers of market swings. That’s why these data-driven moves are usually the best profit opportunities for short-term trading.

However, next Wednesday’s US CPI report really deserves attention. This data is critical because it will directly influence the Fed’s monetary policy and determine whether the US will speed up rate cuts. The global situation is currently unstable, and Trump’s first-rate decision since taking office is coming up. This will be a key moment shaping the US economy in 2025. The CPI report will not only have a huge impact on the US dollar, stock market and crypto market, but it will also trigger major market swings, creating massive trading opportunities.

The core forces driving the market usually fall into two categories. One is organic innovation in the economy. For example, the recent DeepSeek event was a breakthrough in AI technology that reshaped the valuation logic of the AI sector, attracted global attention in the tech market and drove capital flow and investment in related fields.

The same market logic applies to AQS tokens. During the last upgrade, AQS jumped from $0.50 to $1.70, a surge of over 300%. This was mainly due to tech improvements, rising market demand and higher investor expectations.

This upgrade not only includes the most advanced AI technology but also integrates real trading experience from thousands of top analysts, making the system’s trading strategies more precise and efficient. Plus, this upgrade has a much larger public test and promotional effort, which is expected to bring massive capital inflows into the AQS ecosystem, further boosting token demand and price.

With the quantitative trading system about to launch, market expectations for AQS tokens have surged, and its price increase is expected to exceed the previous 300% jump. In other words, if you invest £100K in AQS tokens now, your potential profit could reach £300K or even higher once the system officially launches. This not only shows how tech innovation drives market value growth but also proves that catching trends at the right time can create huge wealth opportunities.

Another key driver is government policy, including economic and monetary policies, which shape the overall market direction. For example, the Trump administration’s recent tariff hikes are a typical economic policy adjustment. The impact of this move has already been seen in market trends over the past few days, causing major swings in the stock market, forex market and commodities market. In the coming weeks, the market’s primary focus will shift from the trade war to the Fed’s monetary policy, and the CPI report will be the key factor that will influence the Fed’s decision.

The CPI data directly reflects inflation levels, and inflation is the core factor in setting interest rate policies. If CPI comes in higher than expected, it means inflation is still strong; the Fed may delay rate cuts or even keep rates high for longer. This would hurt market risk appetite, putting short-term pressure on the stock and crypto markets. But if CPI comes in lower than expected, the market will bet more heavily on Fed rate cuts this year, driving capital back into risk assets and pushing the stock market and crypto market higher. So, this isn’t just another economic report; it’s a key turning point that will shape the market’s direction for the next few months.

For our students, next Wednesday’s CPI report will be a trading opportunity you don’t want to miss. Many investors wish for both low-risk and high returns; CPI data is the perfect example of such an opportunity. Since the market expects major volatility from this report, arbitrage trading becomes one of the best strategies.

The core logic of arbitrage trading is to take advantage of market imbalances and maximize returns while keeping risk low. For example, we can use signals from the quantitative trading system to build positions across different assets based on time gaps and volatility differences. This data-driven trading approach not only ensures safety during big market swings but also maximizes profit potential, making full use of market sentiment shifts.

The CPI market reaction is an incredible trading opportunity for students with larger capital. This type of data release often triggers massive market swings; a single successful trade could generate more profit than ten regular trades combined. Arbitrage trading strategies work even better in these conditions because they not only capture excess returns from market volatility but also use smart risk management to lower trading risks. The most crucial thing in trading isn’t how much you make in one trade but how you use arbitrage strategies to stay consistently profitable through market swings. This CPI report will be a key moment to test our trading skills and take our profits to the next level.

The current market environment has created an incredible trading opportunity for us; the performance of the quantitative trading system has been truly impressive. It not only provides us with highly accurate trading signals but also makes trading much easier, allowing students to execute strategies more efficiently. Of course, today’s success didn’t happen overnight. Our team has faced many challenges along the way. Looking back at the early upgrade stages, we encountered strong resistance from both inside and outside the industry. We faced pressure from certain financial institutions, especially when gathering investment experience from thousands of professional analysts. Some even directly warned analysts not to work with us. Despite this, we remained committed to integrating these top investors’ strategies into our system, ensuring that users get the most precise trading signals.

Not only that, but we also faced major obstacles during system testing. The version test originally scheduled for Oct 2024 was delayed due to interference from investment banks and legal disputes. The public test in January of this year faced challenges from multiple directions. From launching and promoting the public test to managing initial funding, our team overcame countless hurdles to make it happen. In the end, the public test was a success and received an even stronger market response than expected. Over the past few months, global investment conditions have been rapidly shifting due to geopolitical uncertainty and rising trade conflicts. Yet, the quantitative trading system has proven its ability to adapt and generate profits in this ever-changing market.

We made solid profits by targeting tech stocks like Super Micro Computer (SMCI) and Tesla (TSLA) in a tough market environment. Recent plays on COIN, INOD and crypto markets also proved the system’s strength once again. The public test just ended, but it has already caused a big stir in the market. Even AQS tokens surged 80% due to market sentiment. The results prove that this wasn’t just a successful test; it was a major breakthrough for the market.

However, the more we lead the industry, the more opposition we face. Recently, attacks from the financial sector and competitors have clearly increased. Some have even spread rumours online, claiming that our public test was just a way to profit off users’ trading accounts. Others question why we would help students make money for free. These claims are not only baseless but also ridiculous. In reality, all students who joined the public test, including our internal team members, understand the real purpose behind it. First, the quantitative trading system’s performance must be tested to ensure its stability and accuracy in different market conditions. Second, the system should be promoted before its official release.

Yes, promoting and selling a quantitative trading system is a business activity, but that doesn’t conflict with students making profits. In fact, the two go hand in hand. The project team needs market feedback to improve the system, and students can use this opportunity to generate steady profits. In other words, letting students make money during the public test is completely fine. Is helping people profit now considered wrong? Is offering a free test version suddenly a crime? Whose interests are being threatened, leading to so many attacks against us?

Any tech breakthrough brings industry change, and some people will lose their market position. Just like self-driving tech threatens traditional drivers, the success of our quantitative trading system will challenge traders and firms relying on manual analysis. Still, we believe innovation is about making markets more efficient, not holding back progress. We won't back down from these baseless attacks. Instead, we'll push even harder to advance this technology and provide better trading tools for more investors.

I also know that many investment firms and traditional analysts will face serious challenges once the system officially launches. But this is how progress works; it can't be stopped. For example, cars replaced horse-drawn carriages, e-commerce disrupted retail, and every tech leap has reshaped industries. Our system is no different; it's a major breakthrough in financial tech. We won't step back. Instead, we'll invest even more in innovation to ease the transition and help more investors benefit from these changes.

Of course, we have to admit that with so many students, we couldn't take care of everyone, which led to a small number of members not getting ideal returns during this period. The main reason is that some students were too busy with work to follow the trades, or they followed but didn't strictly follow the trading strategy, resulting in short-term floating losses.

I understand that this situation may cause anxiety, but that should never be an excuse for attacks or defamation. We have always been committed to transparent and fair trading guidance, providing students with accurate market analysis and the best trading strategies.

Recently, there have been some malicious defamation and false accusations in the market, trying to mislead investors by smearing the quantitative trading system and our teaching model. In response, we have hired a professional legal team to file lawsuits against those spreading false rumours to protect our team's and all students' legal rights.

At the same time, we also understand that any new technology will face resistance from industry competitors and rejection from traditional markets. But history has proven countless times that technology and innovation truly drive the market forward. We are ready to face these challenges and stay firm on this path of transformation.

The market is about to see a series of key economic data releases, including the Bank of England's interest rate decision, US non-farm payroll data and the most important US CPI data next week. Economic data releases often bring big market swings, and these swings are exactly what our trading system is best at capturing. CPI data is the key factor in determining the Fed's rate-cut pace. If the data beats expectations, the market will see huge price moves, creating a golden opportunity for short-term and arbitrage trades.

We hope all students prepare in advance. Those with enough funds can consider increasing their trading size to seize the coming arbitrage opportunities. We are in a golden period of the market; this is not just a data-driven profit opportunity but also a key moment in building wealth through market volatility. Let's stay confident, stick to precise strategies and win the profits that belong to us in the coming market moves.